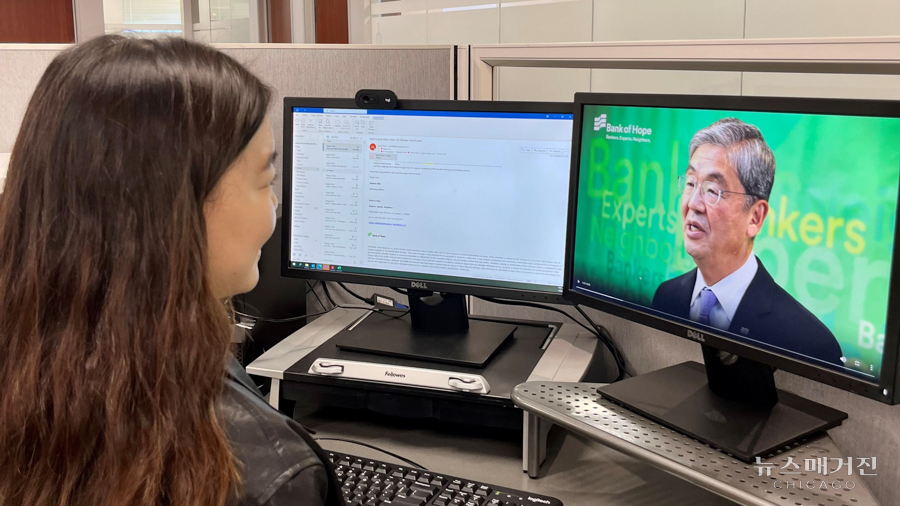

뱅크오브호프 케빈 김 행장, 동영상 신년사 전하며 '고객 중심' 강조

뱅크오브호프 케빈 김 행장이 3일, 자사 사내시스템을 통해, 전 직원들에게 동영상으로 신년사를 전했다.

케빈 김 행장은 ‘2022년에는 뱅크오브호프 출범 이후 가장 높은 대출 성장을 기록’했고 ‘전 직원의 협력을 통해, 더 강하고 탄력적인 조직이 되었다’며 애써온 직원들에게 감사를 전했다.

이어, ‘계속 이어지고 있는 물가상승과 노동시장 문제, 경기 불황에 대비해, 고객 서비스의 질은 유지하면서 비용을 최소화하는 방안을 마련해야 한다’고 말했고, 지속적인 성장을 위해 ‘은행이 하는 모든 일에 고객을 가장 중심에 두는 것이 최우선 과제’라며, ‘고객 중심 문화를 구축하는 것이 동종 업계에서 우위를 확보하고 유지하는 핵심 능력’이라고 재차 강조했다.

[제공: 뱅크오브호프]

케빈 김 뱅크오브호프행장의 신년사 전문

Hello and Happy New Year to everyone at Bank of Hope! I hope you enjoyed a joyous holiday season and are off to a great and healthy start to 2023.

While we have yet to close the books for the final quarter of the year, we had strong results in certain areas of our business in 2022. At the same time and as a result of the very volatile macroeconomic environment, we have significant challenges related to deposits.

• 2022 was a record-breaking year in terms of new loan origination volumes, generating the highest level

of net loan growth since becoming Bank of Hope.

• This performance helped produce the margin expansion, efficiency improvements, and increases in

profitability from the previous year.

• Importantly, our enhanced credit administration processes and tightened underwriting criteria

contributed to continued improvement in asset quality trends in our portfolio, with reductions across

the board in all categories of nonperforming assets and criticized loans.

• Deposits, on the other hand, faced severe headwinds from the faster-than-anticipated interest rate

hikes, and we expect our deposit growth to be minimal, with an unfavorable shift of deposits to highercost time deposits.

In part due to the stronger commercial banking capabilities that we have built since becoming Bank of Hope, we have been able to manage through the macroeconomic headwinds that have accelerated throughout 2022, as well as the ongoing pandemic challenges. The investments we have made to build expertise in new asset classes and vertical markets in all areas of our business have resulted in a material transformation of our loan portfolio to a significantly lower-risk profile, which reflects a much better diversified CRE and C&I portfolio.

Overall, we have grown significantly since the merger that created Bank of Hope, having already exceeded $19 billion dollars in total assets. And this growth has not been just in size. We have a large portion of our current staff who have been with the organization since well before the merger. We have also added significant talent and capabilities in many existing and new areas of the Bank. I thank all of you for your ongoing commitment and dedication. By working together in collaboration, we have become a stronger, more resilient organization that will prosper for many years to come.

Looking forward as we begin 2023, with persisting inflation and a challenging labor market on top of a looming recession, we need to be prudent and ask ourselves hard questions about how we can improve our financial performance. In preparation for the looming recession which may be more severe than initially predicted, it will be imperative that we significantly tighten our belts and find ways to minimize expenses without sacrificing the service that we provide to our customers. In times of economic difficulties, most companies will look to reduce costs. And to be successful, we must carefully do so from every facet of our organization.

Our plan is to focus on reducing costs without sacrificing the service that we provide to our customers. For example, many of our employees have utilized the hybrid work policy post Covid, and, as a result, we have meaningful cost reduction opportunities to optimize the space utilization of our corporate offices by eliminating underutilized spaces and transitioning to a shared space policy.

The pandemic has also accelerated our digitalization journey. Our Cloud Migration of critical business needs supports the agility and adaptive nature of our organization. We will also look to automate more of our processes to reduce the cost of doing business. And we will continue our efforts to produce more relevant digital products and services that will improve customer, as well as employee experiences.

We believe these strategies will help to mitigate the negative effects of economic pressures in the short term and build competitive advantage in the long run.

While the operating environment looks to become even more challenging, we expect to continue benefitting from the significant shift we have made to a more relationship-focused commercial banking model over the past few years, which has had a positive impact on our loan production volumes, our deposit gathering, and the diversification of our franchise. At the same time, we very much appreciate the value of our solid retail banking infrastructure as a stable source of revenues, which will be critical in coping with the volatility in the markets that we expect to see in 2023.

To further advance our progress notwithstanding the challenges of the current environment, we must

continue to make customer-centricity a top priority and focus in all that we do. We must constantly focus on improving our overall services and relationships to maintain and strengthen our value to our customers, both externally and internally, if we want to continue achieving higher grounds.

As I stated last year in my New Year’s message, building a customer-centric culture at Bank of Hope will be the key to our ability to differentiate us from our peers and gain and sustain our competitive advantage. Again, this year, I am calling on everyone to embrace a customer-centric attitude in all that we do at Bank of Hope. And I expect all executives to lead an acceleration in the refinement of our processes, products and services designed to advance this customer-centric focus.

Recently, we published our inaugural Environmental, Social and Governance (“ESG”) Report, which charts our ESG journey at Bank of Hope. From our very beginnings, we have been committed to being a responsible corporate citizen for our customers and communities. Today, as the representative bank of the Korean American community and one of the largest regional Asian American banks in the nation, we recognize the important role we play in continuing to create a socially responsible and sustainable future.

As we begin this journey, we are thankful that our rooted corporate culture and philosophies serve as a sound base upon which we plan to build out a more comprehensive ESG program. In addition to our commitment to corporate governance and social practices that foster diversity, inclusion and economic equity, we look forward to engaging in environmental stewardship in the years to come.

Thank you all for your a part of Bank of Hope, whether you have been with the Bank for many years or have recently joined. I believe we have an amazing journey ahead of us, and as Chairman, President and Chief Executive Officer, I am truly grateful to have in my team.

On behalf of the entire Board of Directors and executive management team, I wish all the best for you in 2023,including great success, health and prosperity!

Thank you! God bless all of you and God bless Bank of Hope.

Kevin S. Kim

Chairman, President & CEO

Bank of Hope